student loan debt relief tax credit 2020

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. The government has loan forgiveness options for low-income borrowers but if you have a large.

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

For help with Federal Student Loans call the.

. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. In the past however loan. 1 the Internal Revenue Service IRS will not assert that these taxpayers must.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least. Theyll pay more than 10250 in interest alone if they. Lower interest rates loan forgiveness debt relief.

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Cancel up to 50000 in student loan debt for borrowers with 100000 or. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be.

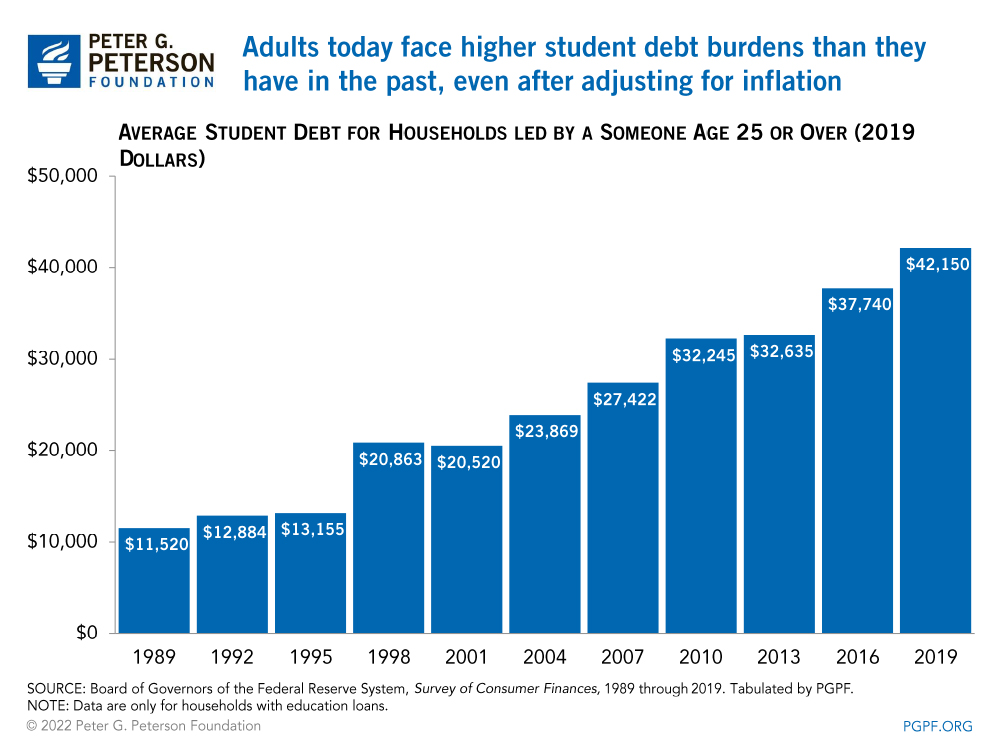

Instructions are at the end of this application. It requires a completely. There are more than 45 million American borrowers who collectively owe nearly 16 trillion in student loan debt a burden amounting to nearly 8 of national income.

Say a borrower has the average student loan balance of about 37500 at 5 interest and is on a 10-year repayment plan. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter the amount on the certification from the Maryland Higher Education. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt.

Student Loan Debt Relief Act legislation to cancel student loan debt for 42 million Americans. Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500.

They will review your case evaluate your options for switching repayment plans. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a.

The AOTC offers a credit of 100 on the first 2000 of qualifying educational. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred.

2018-39 provide the following relief. For Maryland Residents or Part-year Residents Tax Year 2020 Only. As of March 11 2021 Biden signed the American Rescue Plan into law which included a provision that all student loan forgiveness is tax-free.

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education. In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria.

You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions. For help with Federal Student Loans call the Student Loan Relief Helpline at 1-888-906-3065. Student Loan Debt Relief Tax Credit Application.

If the credit is more than the taxes owed they will receive a tax refund for. Complete the Student Loan Debt Relief Tax Credit application. Student Loan Debt Relief Tax Credit Application.

From July 1 2022 through September 15 2022. Under the new law no payments are required on federal student loans. Put another way.

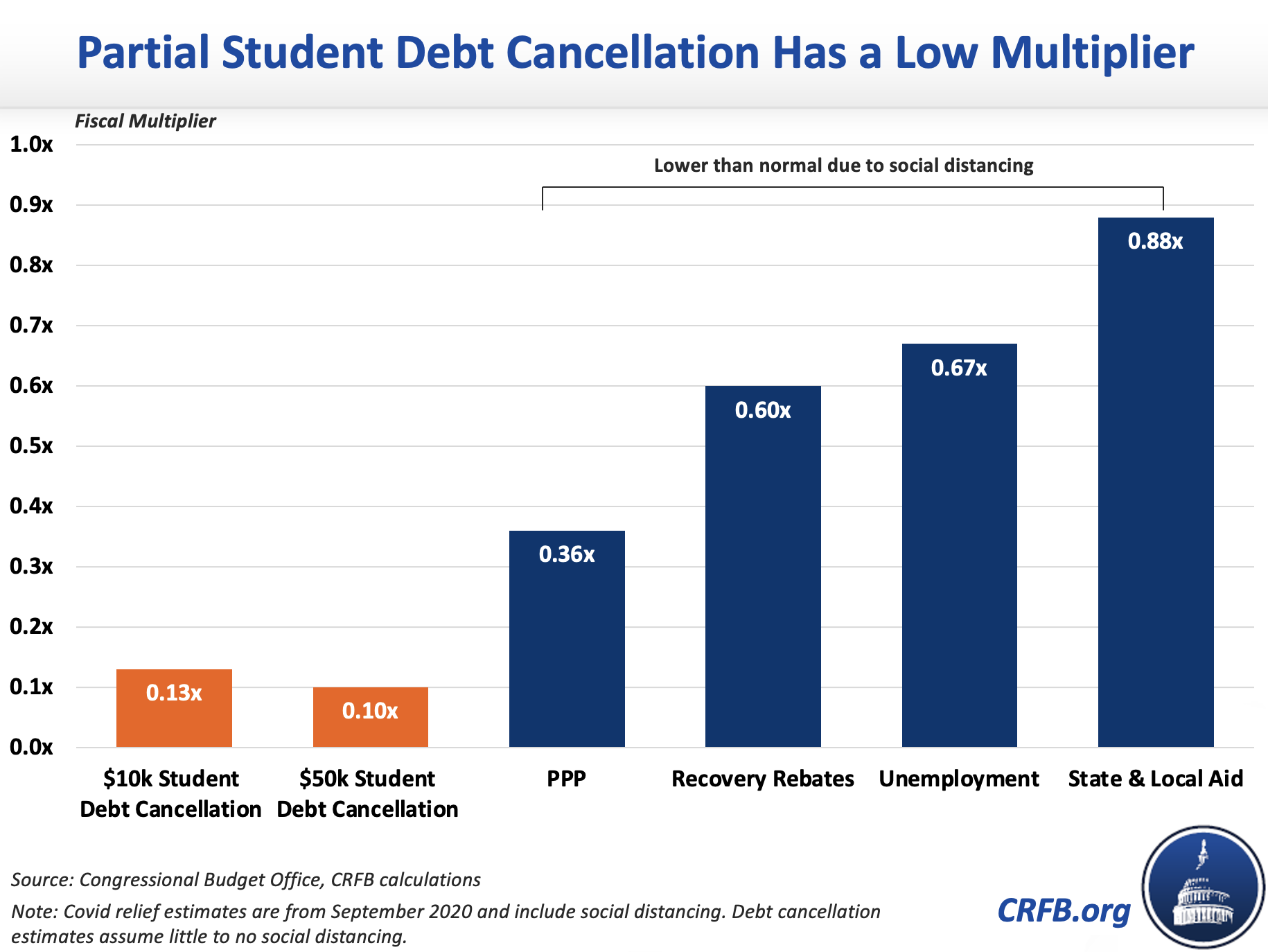

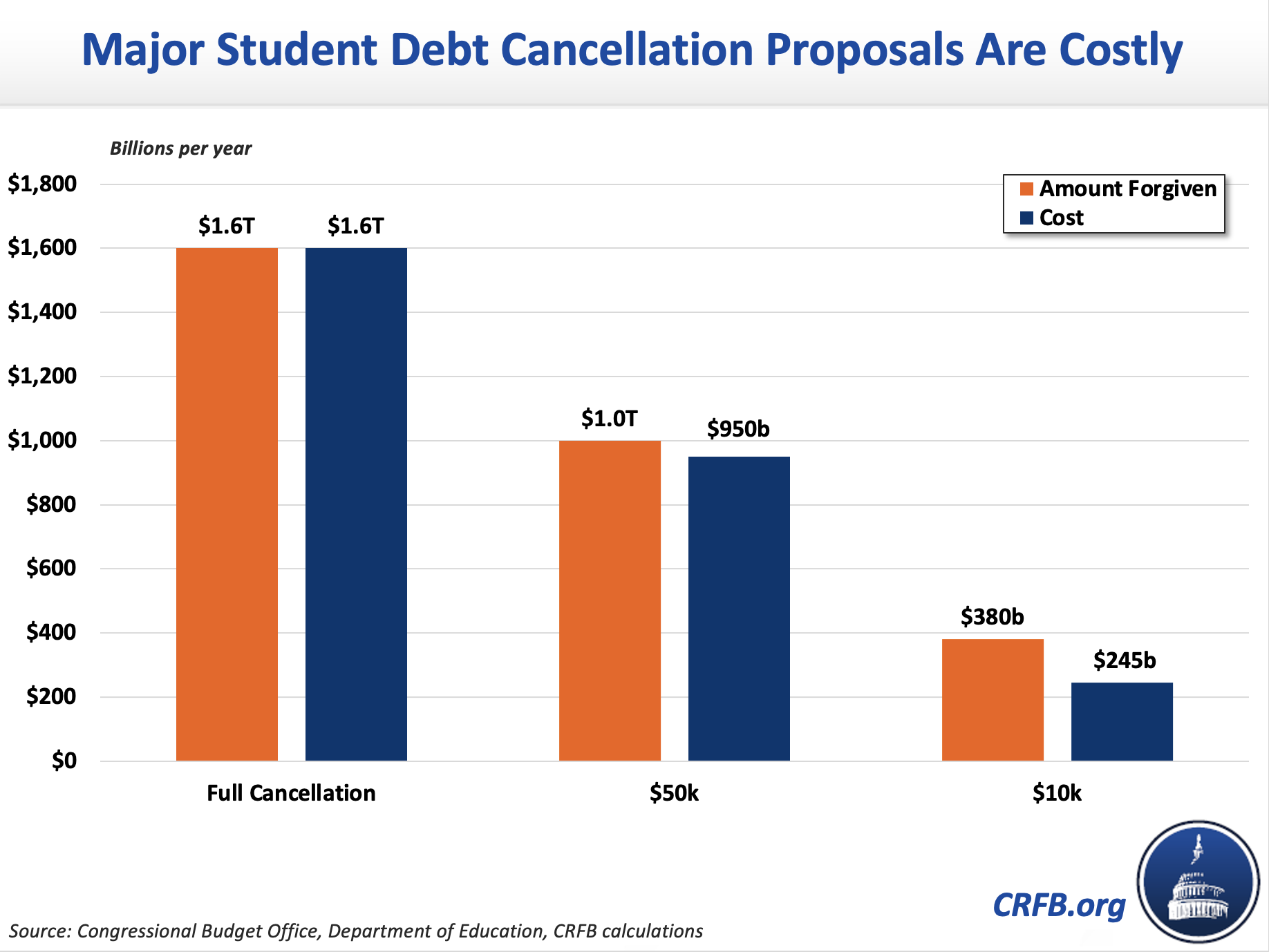

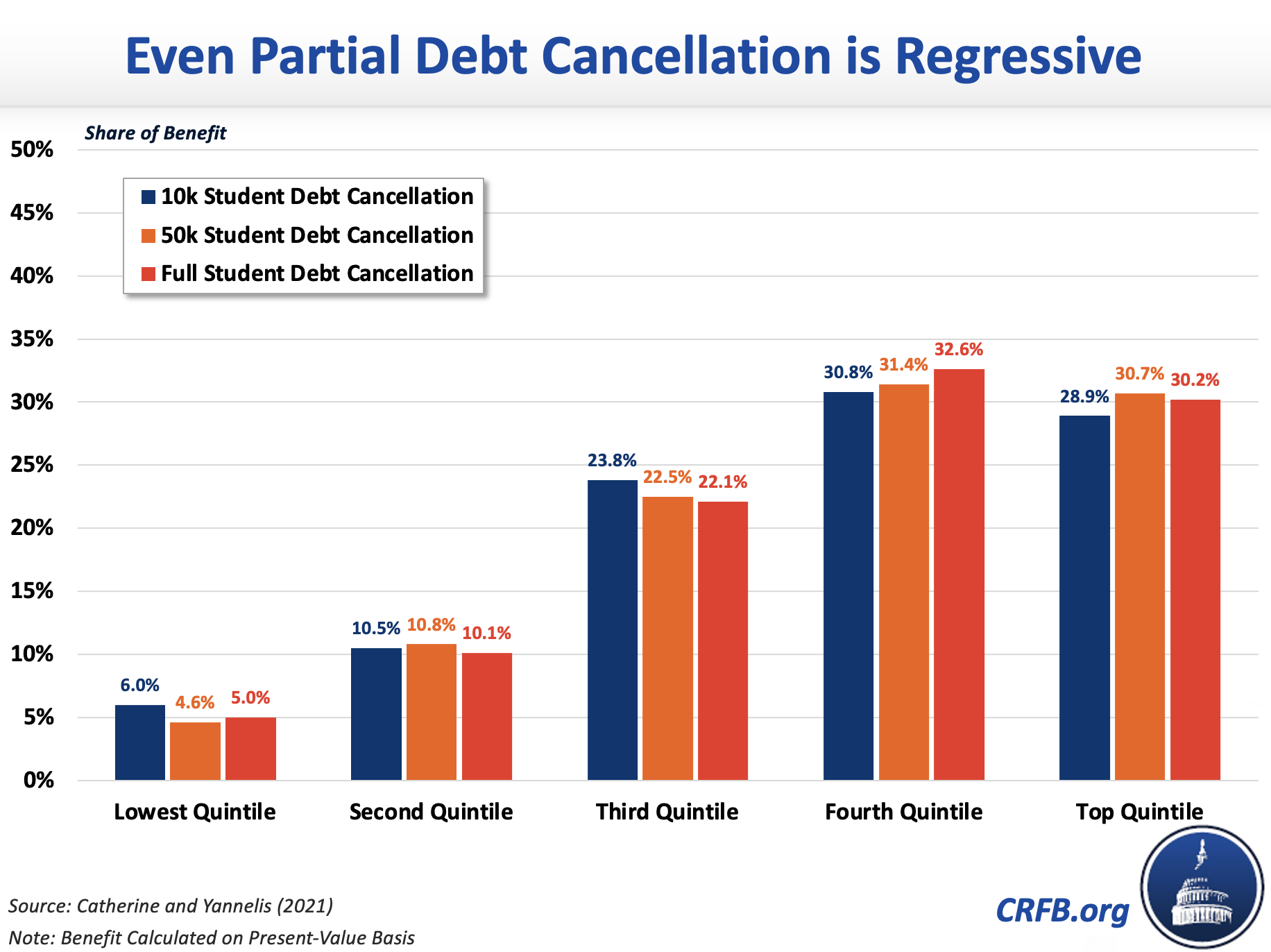

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

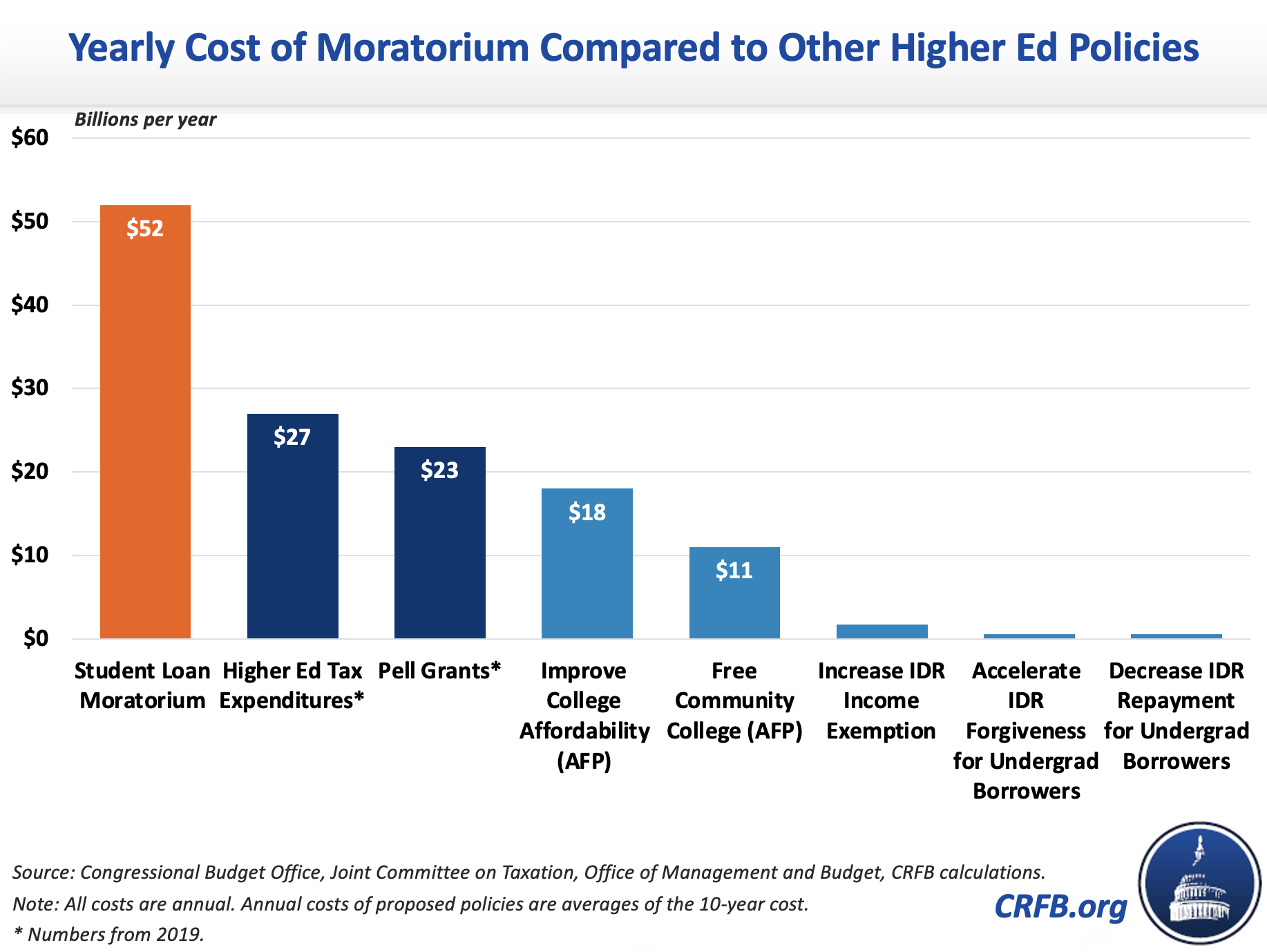

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

What Are The Pros And Cons Of Student Loan Forgiveness

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Chart Americans Owe 1 75 Trillion In Student Debt Statista

What Are The Pros And Cons Of Student Loan Forgiveness

What Are The Pros And Cons Of Student Loan Forgiveness

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

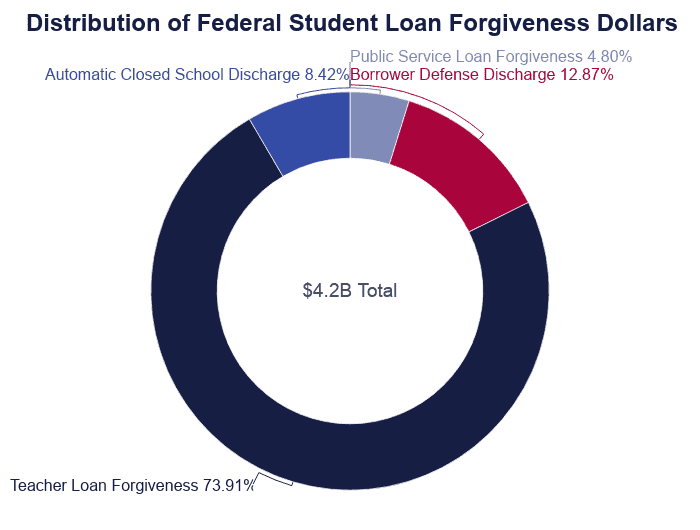

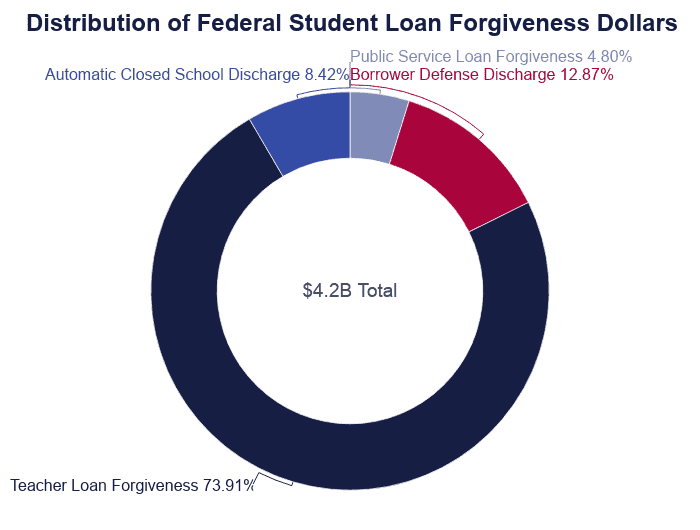

Student Loan Forgiveness Statistics 2022 Pslf Data

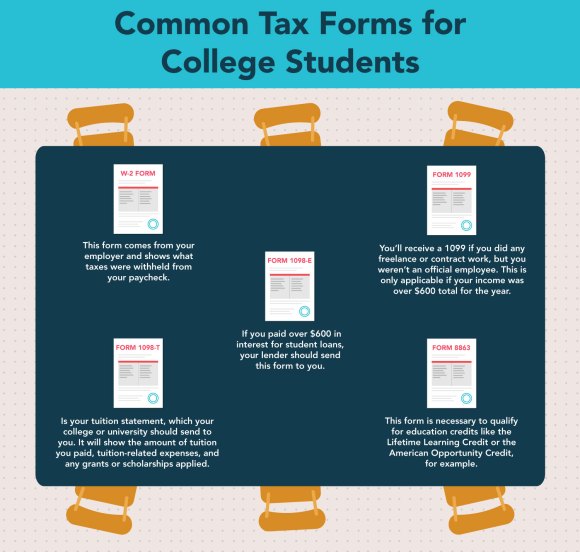

Can I Get A Student Loan Tax Deduction The Turbotax Blog

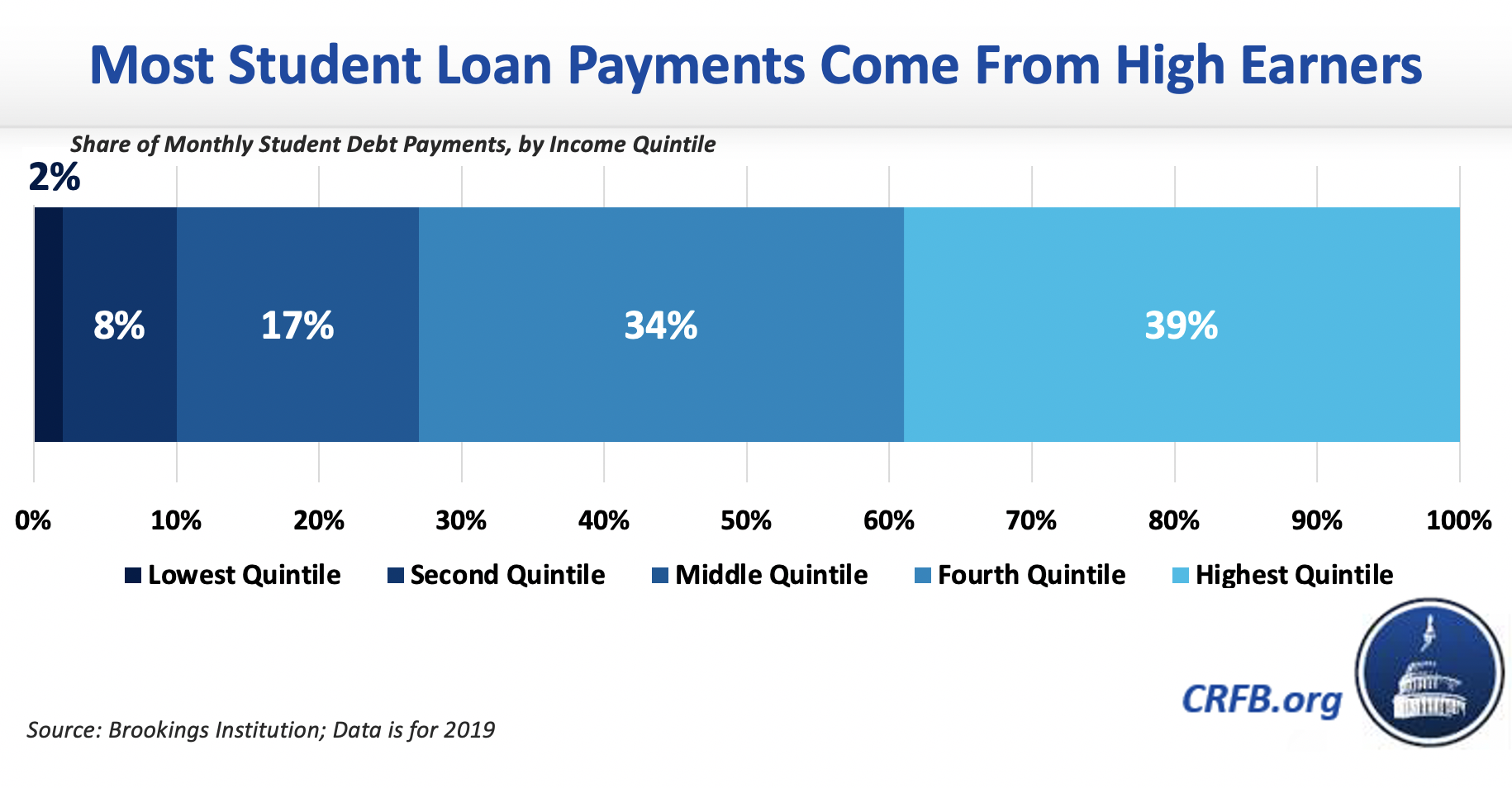

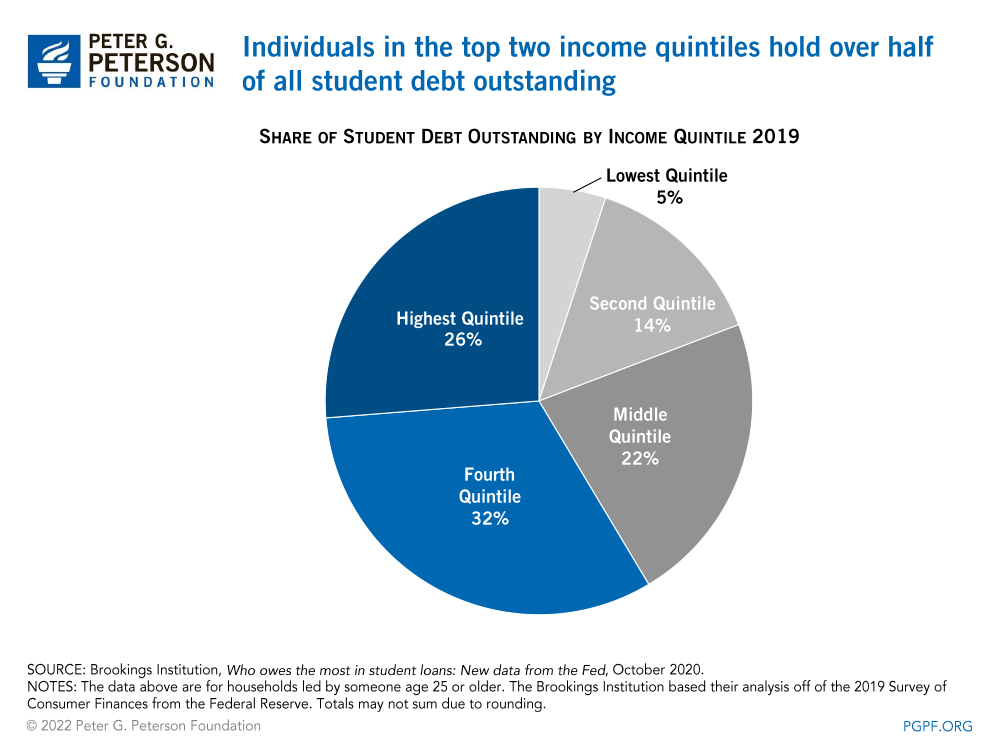

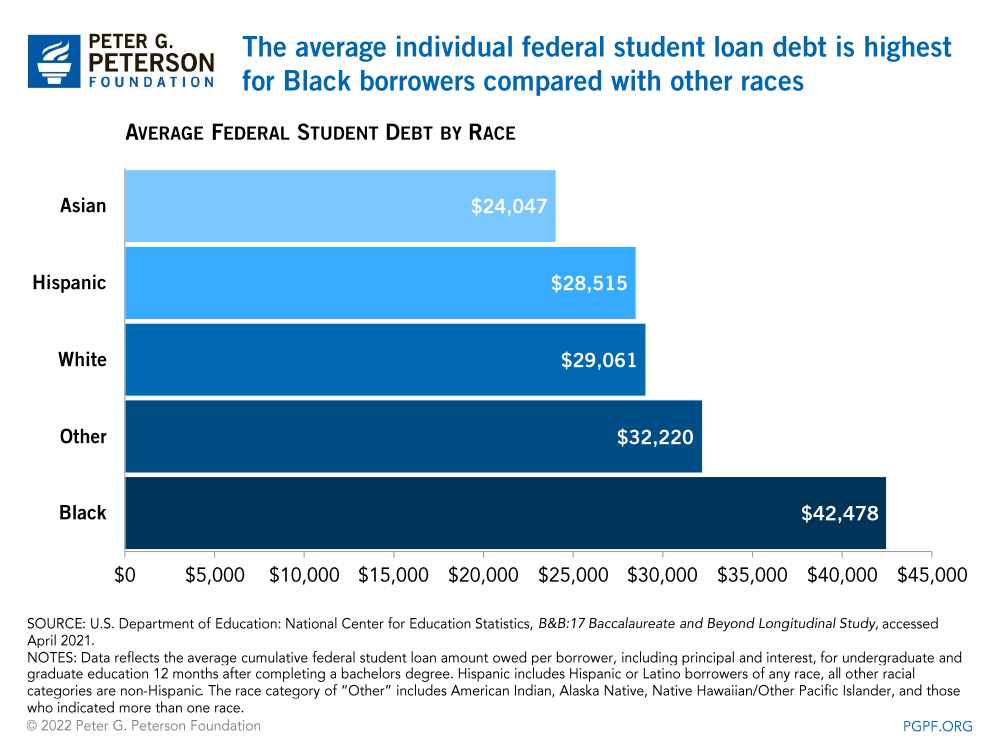

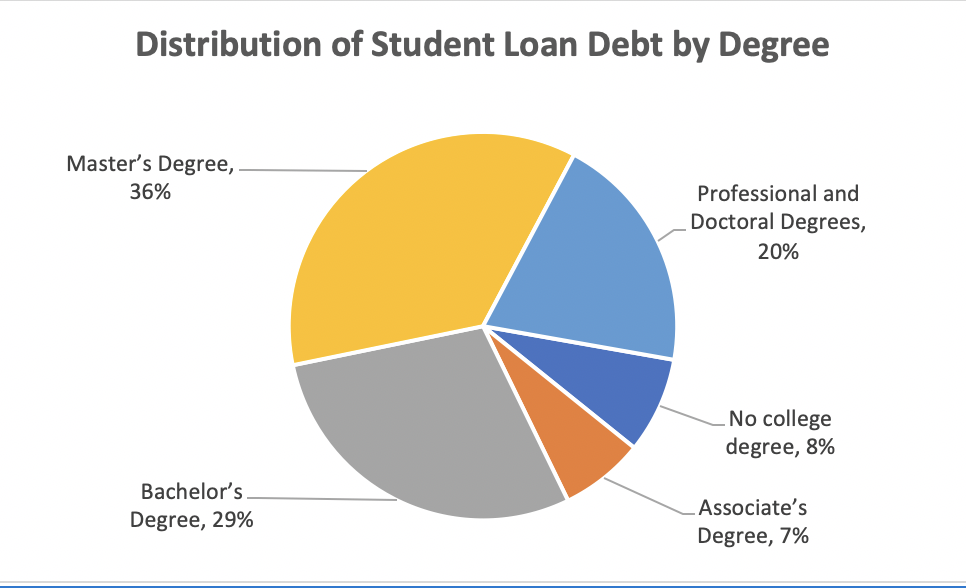

Who Owes The Most Student Loan Debt

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Debt Relief Options When Forbearance Ends Credit Karma